The Great Realignment: Trump’s Tariff Gambit and the Future of Global Trade

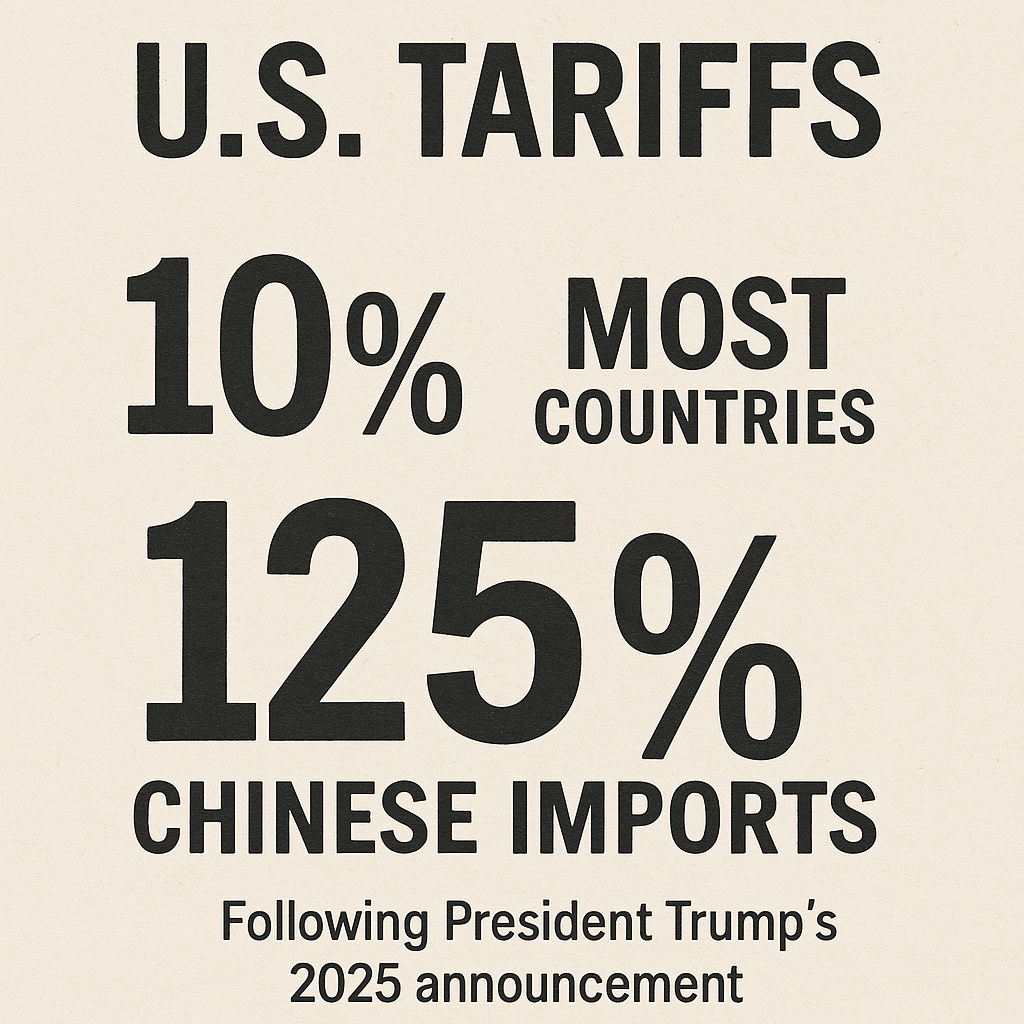

On April 9, 2025, President Donald Trump did what he does best—disrupted the status quo. With the flourish of a press conference and a tweetstorm to match, he announced a sweeping new tariff policy that stunned both friend and foe: a 90-day pause on new tariffs for most countries, reducing the general tariff rate to 10%, while hammering Chinese imports with a crushing 125% levy.

That sound you heard? It was the collective gasp of the global trade establishment.

For someone who made his name on “America First” and an unwavering trade war stance, this move felt paradoxical—even surreal. But peel back the layers, and you start to see the strategy. It’s not just about punishing China. It’s about resetting the board.

The Announcement That Changed the Game

Let me break it down for you: Trump didn’t just issue a statement. He detonated a trade policy bombshell designed to isolate Beijing while simultaneously signaling an olive branch to the rest of the world.

- General tariff reduction: From an average of ~20% to 10% for most countries

- China-only spike: Tariffs on Chinese goods surged to 125%

- Temporary status: 90-day pause to facilitate trade negotiations

- Diplomatic fallout/invitation: Over 75 countries expressed interest in talks

This wasn’t an accident. This was a chess move—albeit one with the subtlety of a sledgehammer.

Market Reaction: Pop the Champagne (For Now)

The markets? Euphoric. Investors love clarity—or at least the illusion of it. Here’s what happened:

Stock Market

- S&P 500 jumped 7% in a single day

- Tech and industrials led the rally

- Trading volume hit a four-month high

Bond Market

- 10-year Treasury yield spiked to 4.47%

- Heavy demand at auctions brought yields down later

- Inflation expectations ticked up

You could almost hear the suits in Manhattan clinking glasses. But some of us, myself included, saw the hangover coming.

The Jamie Dimon Warning Shot

Jamie Dimon isn’t your average talking head. When he speaks, people listen—and markets tremble. His reaction to the announcement? Cautious. Dimon warned that this high-stakes gamble could backfire.

He cited two key concerns:

- Tariff-induced inflation: Higher costs on Chinese goods could ripple through the economy.

- Confidence erosion: The recent volatility and mixed messaging could spook consumers and investors.

“We are not out of the woods,” he said. And I believe him. Because while markets celebrate, Main Street feels the pinch.

Treasury Secretary Scott Bessent: The Optimist-in-Chief

On the other side, we have Scott Bessent, a Wall Street veteran turned Treasury Secretary. His tone? Relentlessly upbeat.

- Employment: Unemployment remains at a healthy 3.9%

- CEO sentiment: Feedback from business leaders has been “overwhelmingly positive”

- Trade activity: 70 negotiations scheduled globally

To Bessent, this isn’t a crisis. It’s a “realignment.” But history tells us that realignments are often bloody.

Global Trade Dynamics: The Fallout Begins

It didn’t take long for the rest of the world to respond. What Trump did in minutes took other nations hours to process—and retaliate.

China’s Counterpunch

- Tariffs on U.S. goods: Hiked to 84%

- Unreliable entities list: Expanded to include several Fortune 500 companies

This is where the rubber meets the road. China isn’t just fighting back. They’re targeting American firms at the nerve center of supply chains. Firms like Apple, Qualcomm, and Boeing are now navigating retaliatory turbulence.

Europe: Still Playing Chess

- EU tariffs: Focused on steel, aluminum, and autos

- Diplomatic posture: Less aggressive than China, more surgical

- Behind-the-scenes lobbying: European chambers pushing for exemptions

This isn’t about trade. This is geopolitics with balance sheets. And Brussels plays the long game.

Sector Breakdown: The Fallout By Industry

Different sectors are absorbing the shock in radically different ways. Here’s the breakdown:

Technology

- Winners: U.S. cloud and software firms (less reliant on Chinese hardware)

- Losers: Semiconductor giants and hardware manufacturers with deep China exposure

- Wild card: AI startups depending on rare earth minerals now facing procurement issues

Agriculture

- Winners: Domestic producers with markets in Latin America and Africa

- Losers: Soybean and corn exporters targeting China

- Trend: Potential pivot to Middle Eastern and Southeast Asian markets

Manufacturing

- Winners: Small and mid-sized firms with U.S.-only supply chains

- Losers: Multinationals reliant on just-in-time inventories and global inputs

- Shift: Onshoring and nearshoring acceleration likely

The Bigger Picture: A Fork in the Road

Let’s take a step back. What does this all mean? Why does it matter? Here’s how I see it.

Winners

- Domestic manufacturers (especially non-China-dependent ones)

- Countries willing to negotiate

- Emerging markets seeking U.S. access

Losers

- U.S. consumers (short-term inflation risk)

- Multinationals with China exposure

- Global supply chains

What Comes Next?

| Timeline | Event | Impact |

|---|---|---|

| April 2025 | Tariff restructuring announced | Market surge, diplomatic shockwaves |

| May-June 2025 | Trade talks with 70 countries | Opportunities for new deals |

| July 2025 | Review of China tariffs | Potential for escalation or détente |

| Q3 2025 | Corporate earnings season | Real impact on margins, guidance |

This is a high-wire act, no doubt about it.

Final Thoughts: This Is Just the Beginning

I won’t sugarcoat it. What we saw on April 9 wasn’t just another policy shift. It was a declaration of economic war on China and a calculated invitation to the rest of the world.

Trump’s message is clear: “We can work together. Just not with Beijing.”

Whether this bold play leads to a new golden era of American trade or an inflationary spiral remains to be seen. But one thing is certain: the next 90 days will define the decade.

As for me? I’ll be watching the 10-year yield like a hawk and listening for what Jamie Dimon says next.

Because in this game, the loudest signal is often the one nobody hears.

Stay tuned.

Leave a Reply

Want to join the discussion?Feel free to contribute!