CFO Declares “Strategic Finance” Mission Accomplished After Attending 1 AI Webinar

It happened last Thursday. Around 3:47 PM. Somewhere between the third slide on “AI-powered FP&A automation” and the host’s pitch for a trial subscription, a CFO stood up from their Herman Miller chair, stared blankly out the window like a prophet seeing the void, and declared:

“We’re done here. Strategic finance: mission accomplished.”

No one clapped.

But the smell of microwaved salmon still lingered from lunch, and that was enough of a ceremony.

This, dear reader, is how the modern finance transformation ends. Not with an audit trail, but with a 45-minute AI webinar and a LinkedIn post.

The Rise of the Artificially Informed Executive

Let me first say this: I love a good webinar. They’re the digital equivalent of an offsite retreat, minus the awkward icebreakers and suspiciously enthusiastic facilitators. But let’s not confuse being informed with being transformed.

The AI hype train has left the station, and it’s picking up CFOs faster than a Sarbanes-Oxley violation picks up compliance flags. One moment you’re logging in for a harmless session on predictive analytics; the next, you’re leading a company-wide reorg, convinced that machine learning just solved your long-range planning model.

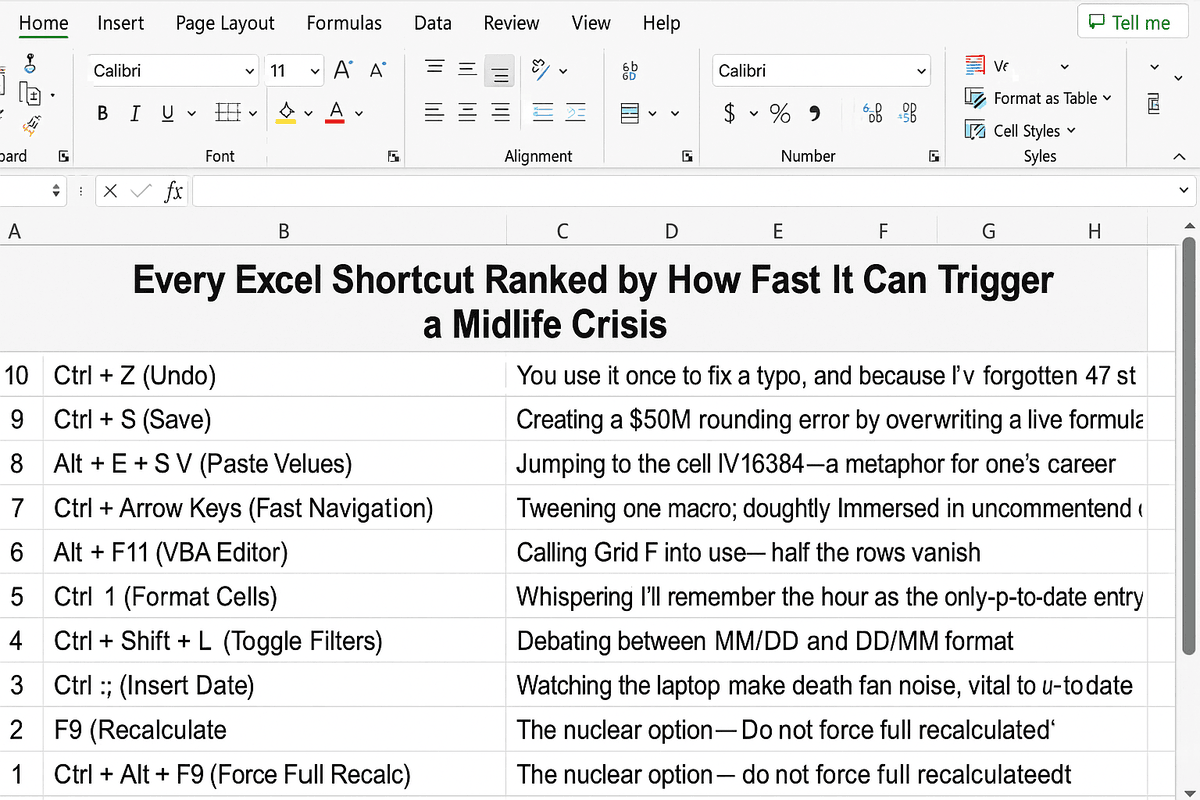

What did the CFO learn in this webinar?

- ChatGPT can write board decks.

- Excel is dead (again).

- Forecasting is now a solved problem.

- Human judgment is “optional.”

And just like that, decades of strategic rigor, scenario planning, and capital discipline are replaced by a slide deck with too much Helvetica and a demo featuring a chatbot that can spell “EBITDA.”

A New Kind of Strategic

Let’s pause for a moment and remember what “strategic finance” used to mean. It meant:

- Capital allocation rooted in actual return analysis.

- Risk management that went beyond toggling assumptions.

- Operating plans tied to real constraints, not wishcasting.

- Leadership with domain knowledge deeper than a Twitter thread.

Now? Strategic finance means you once asked ChatGPT for a SWOT analysis.

It means you dropped a buzzword like “generative forecasting” in a QBR.

It means you replaced your FP&A team’s entire playbook with a screenshot of a prompt that says: “Give me a 3-year integrated financial model with commentary.”

Let’s be clear: none of this is strategy. This is theater. It’s finance-as-improv, with a chatbot on stage and the CFO doing jazz hands.

The Real Cost of Confusing Tools with Thinking

There’s nothing inherently wrong with AI. Used well, it can:

- Streamline rote processes (e.g., variance analysis, basic forecasting)

- Enhance scenario planning (via probabilistic modeling)

- Surface insights faster (with NLP layered over BI tools)

But used poorly, it becomes a form of executive malpractice.

Case in point: I watched a mid-market CFO proudly announce that their entire planning process had been ‘reimagined’ using a GPT wrapper built over a Google Sheet. The outputs? Hilarious. The implications? Catastrophic.

Here’s a table to illustrate the difference:

| Claim | Reality |

|---|---|

| “AI replaced our FP&A team” | Chatbot generated gibberish, manually corrected |

| “We predict cash flows in real-time” | Model lags actuals by three weeks |

| “Insights on demand” | Pre-canned dashboards no one understands |

| “Automated scenario planning” | Random toggling of 3 variables |

| “Hyper-efficient close process” | Still waiting on two subsidiaries for data |

Webinars don’t teach you how to model working capital. They don’t help you understand the political economy behind commodity pricing. They don’t walk you through a debt covenant waterfall. They don’t teach you when not to listen to AI.

Tips for the Sane, Sober CFO

If you’re a CFO (or pretending to be one), here are some practical ways to get real value from AI without turning into a parody of yourself:

- Define your objective clearly: AI is a tool, not a vision. Know what you’re solving for.

- Start with the boring stuff: Journal entry categorization, invoice matching, spend analytics.

- Establish data governance: Garbage in, garbage hallucinated.

- Maintain judgment: Don’t delegate decision-making to a model you don’t understand.

- Upskill your team, not just your prompts: Teach them how to interpret, not just operate.

- Pilot, don’t proclaim: Build credibility with small wins, not viral posts.

The Strategic Finance We Actually Need

The current environment doesn’t reward recklessness. Credit spreads are widening. Capex is under pressure. Cyber risk is increasing. Regulatory bodies are sharpening their teeth.

Strategic finance today should mean:

- Managing liquidity with military precision.

- Stress-testing plans for plausible worst-case scenarios.

- Prioritizing returns over revenue.

- Building planning processes that work in a world where history is no longer a guide.

In short, it should look more like cold analysis and less like a TED Talk.

You want to use AI? Great. Build a risk model that doesn’t collapse the second your top-line forecast misses by 8%. Use natural language search to reduce the cycle time of audit prep. Use machine learning to detect anomalies in your expense trends before the SEC does.

But don’t call it strategic just because it has a UI and can write a haiku about net income.

A Final Word From Someone Who Actually Built a Model

I get it. You want leverage. You want productivity. You want to tell your board you’re doing something transformational.

But remember: transformation without rigor is just theater. And strategy without discipline is just a press release.

If you’re a CFO or operator navigating this AI-inflected financial Wild West, here’s a modest ask:

- Don’t mistake attending a webinar for building capability.

- Don’t fire your analysts just because a chatbot can do a bad job faster.

- Don’t delegate financial responsibility to a model trained on Reddit.

And most of all, don’t stop thinking. That’s the one thing AI can’t do for you.

If you found any value in this piece, share it. I’m putting in the effort to give you clarity where there’s mostly noise. Strategic finance isn’t dead—but it is up to you whether it survives the next webinar.

How do you plan to build actual strategic capabilities, not just AI-flavored ones?