Rolling Forecasts vs. Budgets: What High-Performing Teams Get Right

Let me be honest: budgets are broken.

At least, the traditional kind.

You know the one: twelve-months-in-advance, set-it-and-forget-it, rooted in last year’s numbers, built to please the board rather than steer the business.

I’ve built those. I’ve torn them apart, too.

Rolling forecasts, when done right, aren’t just a better planning tool—they’re a better way to run a business. And the highest-performing teams I work with? They’re not wasting time arguing over budget variance. They’re adjusting in real time, staying ahead of the curve, and making better, faster decisions.

Here’s what they get right.

The Core Problem with Budgets

Traditional budgets are like New Year’s resolutions: optimistic, rigid, and often irrelevant by Q2.

They fail for one reason: the world changes faster than your assumptions.

Static budgets:

- Lock teams into outdated assumptions

- Encourage sandbagging to protect headcount

- Prioritize compliance over curiosity

- Penalize learning and adaptation

And worst of all? They give leaders a false sense of control.

When I ask CFOs why they still rely on them, the answer is usually some version of: “That’s how we’ve always done it.”

That’s not a reason. That’s inertia.

What Rolling Forecasts Actually Do

Rolling forecasts shift the question from “How did we perform against last year’s target?” to “Where are we going now, and how do we make better decisions today?”

They:

- Update regularly (monthly or quarterly)

- Extend the planning horizon (usually 12-18 months ahead)

- Focus on key business drivers, not just line items

- Enable scenario planning and faster pivots

In short, they treat the forecast like a living organism, not a historical artifact.

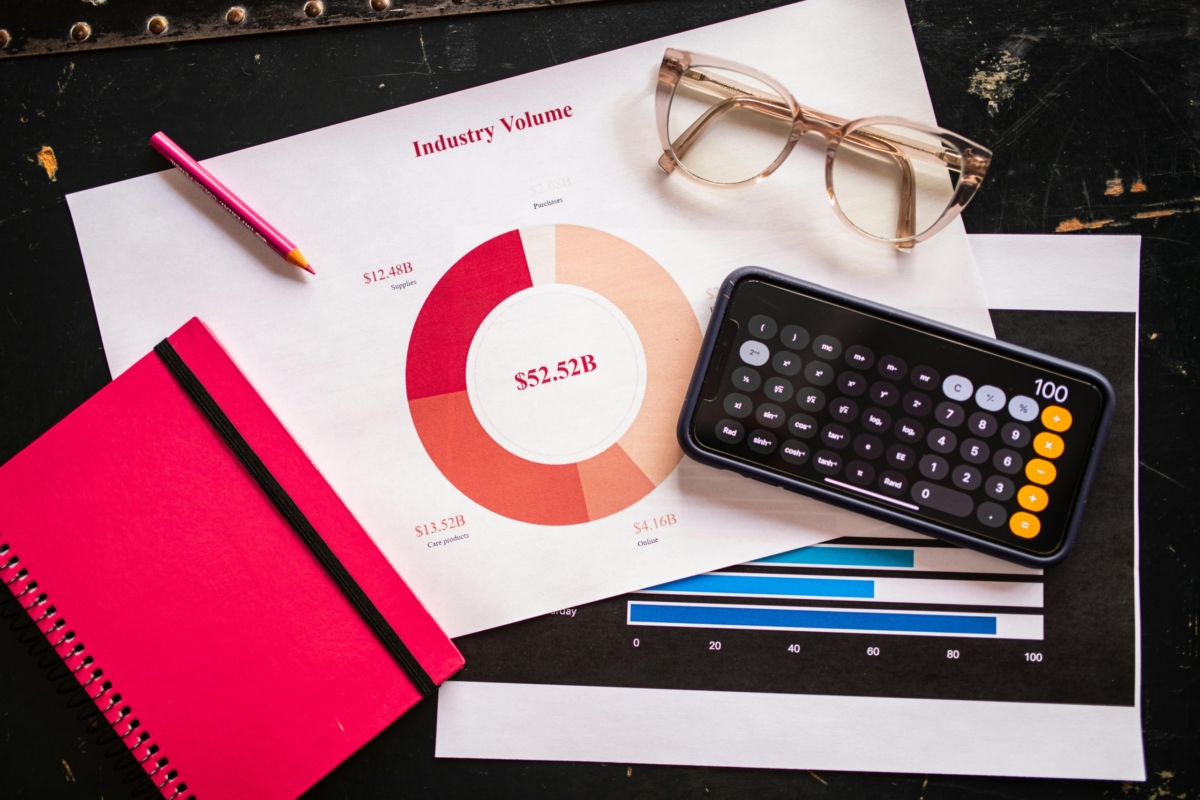

Quick Comparison: Budget vs. Rolling Forecast

| Feature | Traditional Budget | Rolling Forecast |

|---|---|---|

| Frequency | Annual | Monthly or quarterly |

| Time Horizon | Fixed fiscal year | Rolling 12-18 months |

| Based On | Prior year + assumptions | Real-time data + drivers |

| Flexibility | Low | High |

| Focus | Cost control | Business agility |

| Output | Fixed target | Dynamic scenario view |

What High-Performing Teams Do Differently

Here’s what I’ve seen separate the best from the rest:

- They stop fighting last year’s war.

- Budgets are rearview mirrors. Top teams focus on what’s ahead.

- They model drivers, not line items.

- They make forecasting a habit, not a hero project.

- Forecasting isn’t a quarterly panic. It’s a monthly rhythm, embedded in the business.

- They involve operators.

- Finance doesn’t own the forecast alone. Sales, marketing, and product all contribute.

- They tie forecasts to decisions.

- Good forecasts don’t just predict. They provoke action.

Building a Forecasting Muscle

Here’s how I coach finance leaders to make the shift:

- Start simple. Don’t aim for perfection. Aim for participation.

- Pick 3-5 key drivers. Not 300 line items. Focus on what moves the business.

- Use ranges, not false precision. Confidence intervals are your friend.

- Automate the mechanics. Don’t let version control kill the process.

- Tell stories, not spreadsheets. Pair data with narrative so leaders feel the forecast.

When to Use Budgets (Yes, There’s Still a Place)

Look, I’m not anti-budget. I’m anti-blind budget.

Budgets still have a role:

- For setting annual compensation targets

- For managing fixed costs and compliance

- For communicating a baseline to the board

But that’s where they stop. Use them as scaffolding, not as gospel.

Final Thought: Forecasts Are How You Lead

The best finance teams I’ve worked with don’t just report the numbers. They shape the future.

And they do it by shifting from static budgets to living forecasts. From control to clarity. From precision to progress.

If your budget is still running your business, it’s time to flip that relationship.

Because the most strategic finance leaders I know? They don’t follow the plan. They reshape it.