The CFO’s Guide to Scaling Financial Data Prep: From Manual to Automated Workflows

Let me give it to you straight: most finance teams are flying their planes while building the wings. And that’s fine—until you hit turbulence.

I’ve worked with scaling companies where the first $10M in revenue was built on ad hoc Excel reports, stitched together the night before the board meeting. And hey—it worked. Until it didn’t.

You can brute-force your way through early-stage reporting. But once the business grows—more entities, more SKUs, more currency conversions, more investors asking harder questions—manual processes start to eat your time and your credibility.

That’s when it’s time to level up. Not just with a shinier dashboard, but with a real data pipeline that turns your reporting from fire drill to strategic weapon.

In this guide, I’ll show you how to move from manual Excel workbooks to automated workflows using tools like Power Query. And I’ll show you how to do it without losing transparency, traceability, or trust.

Why Scaling Data Prep Matters More Than Ever

Here’s the problem: scaling businesses don’t grow linearly—they grow exponentially in complexity.

More SKUs → more revenue streams → more edge cases in revenue recognition. More headcount → more cost centers → more variance analysis to explain. More investors → more reporting deadlines → less room for error.

If your finance function can’t scale its data prep, your team ends up trapped:

- Reacting instead of driving insight

- Burning cycles on cleanup instead of analysis

- Missing opportunities because the data can’t be trusted

The Roadmap: From Manual to Automated Workflows

Here’s how I think about the stages of financial data prep maturity:

| Stage | Key Characteristics | Risks |

|---|---|---|

| Manual / Ad Hoc | Copy/paste, VLOOKUP, email attachments | High error risk, zero traceability |

| Semi-Automated (Basic) | Linked Excel files, Power Query basics | Fragile links, version confusion |

| Automated & Documented | Central Power Query models, raw data refs | Clear lineage, consistent outputs |

| Fully Integrated Pipeline | Connected to source systems, automated refresh | Minimal manual touch, full audit trail |

Most companies live in Stage 1 or 2 way too long. Let’s break down how to move forward.

Stage 1 to Stage 2: Getting Out of Copy-Paste Hell

First, kill the biggest risks:

- Stop copy/pasting GL dumps. Use Power Query to pull in raw exports.

- Stop building pivot tables on ad hoc data. Build them on structured queries.

- Archive raw data before transformation.

Your goal: create a repeatable process where the same inputs produce the same outputs every time.

Stage 2 to Stage 3: Build Documented, Modular Models

At this stage, you want to:

- Split transformations into logical steps in Power Query.

- Use mapping tables (with version control) for account groupings.

- Document key assumptions in a README tab.

- Use consistent file paths and folder structures.

Why? Because this is where auditability starts. If you can’t explain how a number moved from source to board deck, trust erodes fast.

Stage 3 to Stage 4: Integrated Pipelines

Here’s where the magic happens:

- Connect Power Query directly to ERP APIs or databases.

- Automate refreshes on a schedule.

- Use version-controlled output folders.

- Build automated QC checks into the pipeline (balance checks, outlier flags).

Now you’re not just faster—you’re better. You can prove your numbers, reproduce past reports, and focus your time on insight, not cleanup.

Avoiding Hidden Risks: Data Integrity Best Practices with Excel Power Query

Even a great Power Query pipeline can introduce risks if you’re not careful. Here are common pitfalls and how to avoid them:

1. Overwriting Raw Data

- Always preserve raw imports.

- Reference them with a “Raw” layer query.

2. Hardcoding Transformations

- Use mapping tables, not hardcoded logic.

- Document business rules clearly.

3. Uncontrolled Versioning

- Store versioned outputs in a controlled location.

- Archive each reporting cycle.

4. Lack of QC Checks

- Build validation queries.

- Reconcile totals to ERP.

5. Poor Documentation

- Name queries clearly.

- Annotate complex steps.

- Maintain a pipeline diagram.

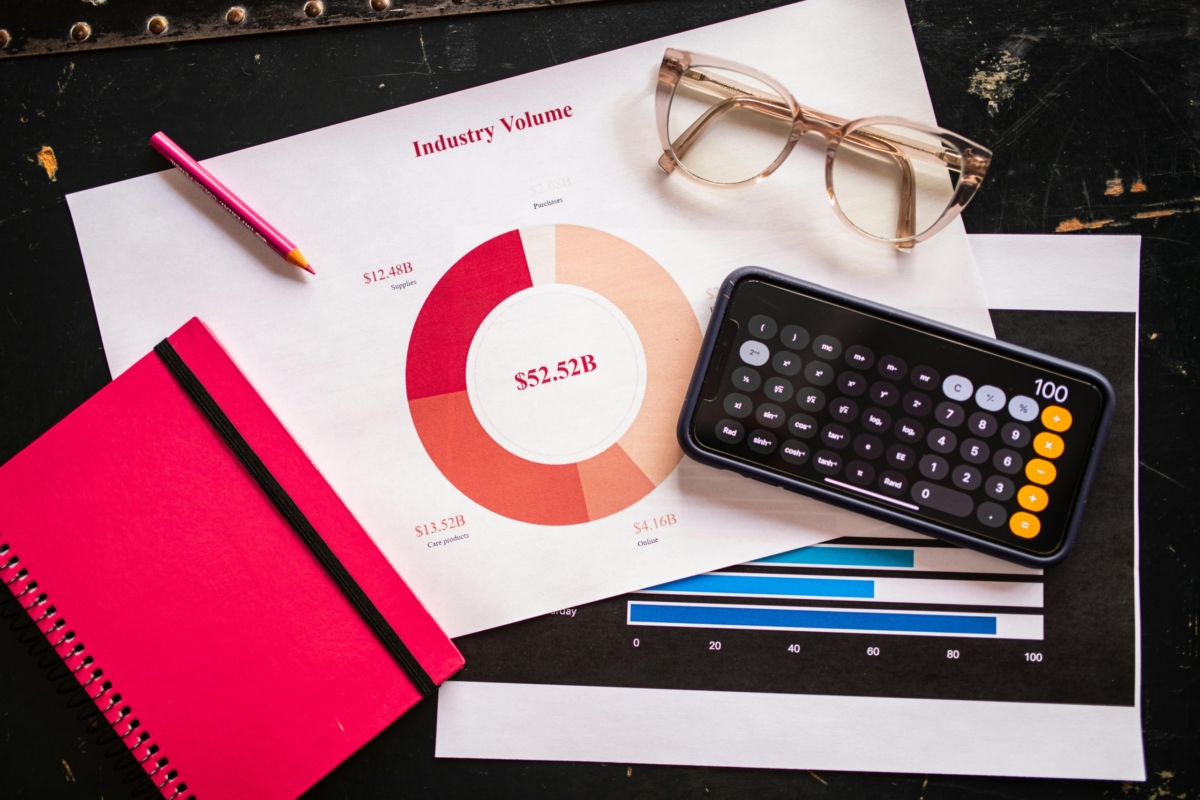

Real-World Example: A $50M SaaS Company

I worked with a $50M SaaS company that was burning 2+ weeks per month on board prep.

Problems:

- GL exports manually cleaned every cycle

- FX rates layered in after the fact

- ARR waterfall rebuilt manually from CRM dumps

- No version control on board deck metrics

We rebuilt the pipeline:

- Power Query connected to raw GL, CRM, HRIS exports

- FX rates table updated monthly, referenced automatically

- ARR model built on top of structured CRM queries

- Outputs versioned monthly, with refresh dates tracked

Result? Board prep went from 2 weeks to 2 days. And the CFO could answer “Where did this number come from?” without breaking a sweat.

Why This Matters to CFOs and Operators

When your finance team is stuck in manual prep:

- You burn time that should go to strategic work.

- You introduce risk with every manual step.

- You can’t respond quickly to new questions.

When you build an automated pipeline:

- You gain consistency and trust.

- You reduce audit and compliance risk.

- You free up your team to focus on what moves the business.

Build for Scale, Build for Trust

I wrote this because too many good finance teams are trapped in spreadsheet purgatory. And the business is moving faster than their data can.

You don’t need to “boil the ocean.” You just need to start moving up the maturity curve:

- From manual to semi-automated.

- From semi-automated to documented.

- From documented to fully integrated.

And Power Query is one of the most powerful tools you can use to get there—if you use it right.

If this article gave you new ways to think about scaling your financial data prep, please share it. I put real time into this because I want more CFOs and finance leaders building trusted pipelines, not just prettier dashboards.

And if you want to go deeper—whether it’s building smarter financial models, scaling your Excel and Power Query game, mastering custom formulas, or sharpening your career strategy—I offer one-on-one consulting for finance professionals ready to level up. DM me if you want to talk.

And here’s an unconventional thought to leave you with: What if your finance team’s competitive edge wasn’t faster reporting—but reporting your operators and board actually trust?

Are you building pipelines that keep up with your business—or ones that keep your team stuck in cleanup mode?